tempe arizona sales tax calculator

Integrate Vertex seamlessly to the systems you already use. Each of these match the federal standard deduction.

Arizona Sales Reverse Sales Tax Calculator Dremployee

See reviews photos directions phone numbers and more for Sales Tax Calculator locations in Tempe AZ.

. Sales Tax State Local Sales Tax on Food. Youll have to pay state and local sales taxes on purchases made in Arizona. Monday - Friday 8am - 5pm.

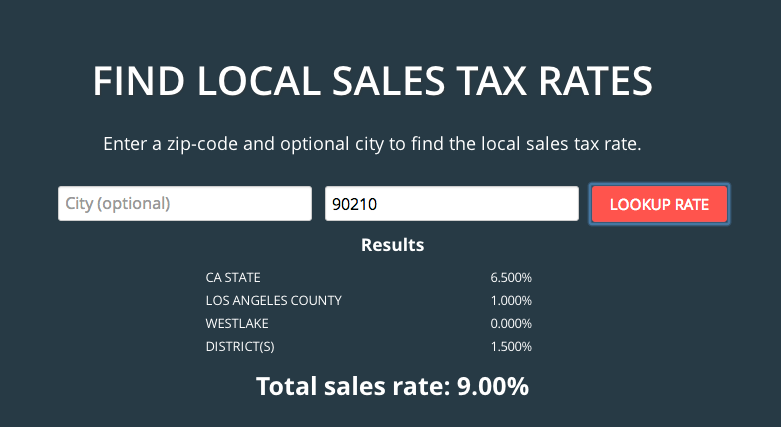

The County sales tax rate is. The Tempe sales tax rate is. The base state sales tax rate in Arizona is 56.

Find your Arizona combined state and local tax rate. RE trans fee on median home over 13 yrs Auto sales taxes amortized over 6 years Annual Vehicle Property Taxes on 25K Car. The 81 sales tax rate in Tempe consists of 56 Arizona state sales tax 07 Maricopa County sales tax and 18 Tempe tax.

The Vehicle Use Tax Calculator developed and implemented by the Arizona Department of Revenue ADOR is a tool that provides that convenience with a one-stop shop experience. If this rate has been updated locally please contact us and we will update the sales tax rate for Tempe Arizona. The Tempe Arizona sales tax is 810 consisting of 560 Arizona state sales tax and 250 Tempe local sales taxesThe local sales tax consists of a 070 county sales tax and a 180 city sales tax.

This is the total of state county and city sales tax rates. The Tempe Sales Tax is collected by the merchant on all qualifying sales made within Tempe. Office Address Mailing Address.

Groceries are exempt from the Tempe and Arizona state sales taxes. The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location. The December 2020 total local sales tax rate was also 8100.

Increased to 300 effective January 1 2003. 2022 Cost of Living Calculator for Taxes. The sales tax rate for Tempe was updated for the 2020 tax year this is the current sales tax rate we are using in the Tempe Arizona Sales Tax Comparison Calculator for 202223.

The Arizona sales tax rate is currently. Ad Find Out Sales Tax Rates For Free. Fast Easy Tax Solutions.

Title 42 Chapter 5 Article 10 with collecting the excise tax imposed only by the state and transaction privilege tax state counties and cities imposed on adult use marijuana sales. Arizona counties calculate a full cash value of every house in the county often based on the sales prices of nearby comparable homes. You can print a 81 sales tax table hereFor tax rates in other cities see Arizona sales taxes by city and county.

Real property tax on median home. Link is external Download User Guide. City of Tempe except City holidays Tax and License.

Tempe AZ 85280 salestaxtempegov. The December 2020 total local sales tax rate was also 6300. Ad Automate Standardize Taxability on Sales and Purchase Transactions.

The Arizona sales tax rate is 56 the sales tax rates in cities may differ from 56 to 112. Arizona has a 56 statewide sales tax rate but also has 101 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 2132 on top. For states that have a tax rate that is less than Arizonas 56 tax is collected by the state of Arizona at the time of purchase.

If you choose not to itemize on your Arizona tax return you can claim the Arizona standard deduction which is 12550 for single filers and 25100 for joint filers. Sales of food for home consumption will be taxed a different rate effective July 01 2010. As we all know there are different sales tax rates from state to city to your area and everything combined is the required tax rate.

The Arizona Department of Revenue ADOR is tasked in ARS. Tempe Tax License. You can find more tax rates and allowances for Tempe and Arizona in the 2021 Arizona Tax Tables.

Impose an additional 200 bed tax. Method to calculate Tempe Camp sales tax in 2021. Did South Dakota v.

A handful of numbers are used to calculate the property tax due on each piece of real estate in Arizona. Arizona sales tax rates vary depending on which county and city youre in which can make finding the right sales tax rate a headache. For more information on vehicle use tax andor how to use the calculator click on the links below.

The average sales tax rate in Arizona is 7695. The rate will 180. The statewide rate is 560.

Tempe Arizona and Mesa Arizona. There is no applicable special tax. Tempe Sales Tax Rates for 2021.

Arizona provides an exemption if you plan to register the car in one of these states meaning you will not have to pay a sales tax even if the transaction occurs in Arizona. The minimum combined 2022 sales tax rate for Tempe Arizona is. How Arizona Property Taxes Work.

Local tax rates in Arizona range from 0 to 56 making the sales tax range in Arizona 56 to 112. The current total local sales tax rate in Tempe Junction AZ is 6300. The current total local sales tax rate in Tempe AZ is 8100.

The first is the current cash value of your home. Tempe in Arizona has a tax rate of 81 for 2021 this includes the Arizona Sales Tax Rate of 56 and Local Sales Tax Rates in Tempe totaling 25. Sales tax in Tempe Arizona is currently 81.

Our Premium Cost of Living Calculator includes State and Local Income Taxes State and Local Sales Taxes Real Estate Transfer Fees Federal State and Local Consumer Taxes Gasoline Liquor Beer Cigarettes Corporate Taxes plus Auto Sales Property and. Modify Section 16-460a entitled Retail Sales. 6th St 3rd Floor.

Wayfair Inc affect Arizona.

Arizona Sales Tax Rates By City County 2022

How To Collect Sales Tax Through Square Taxjar

Arizona Sales Tax Guide And Calculator 2022 Taxjar

Arizona Income Tax Calculator Smartasset

6 75 Sales Tax Calculator Template Sales Tax Tax Printables Tax

2021 Arizona Car Sales Tax Calculator Valley Chevy

Best Accountant Google Search Accounting Jobs Accounting Accounting Career